Court Questions Legality of Combined Demand Notices for Multiple Financial Years; Interim Relief Extended to Petitioners

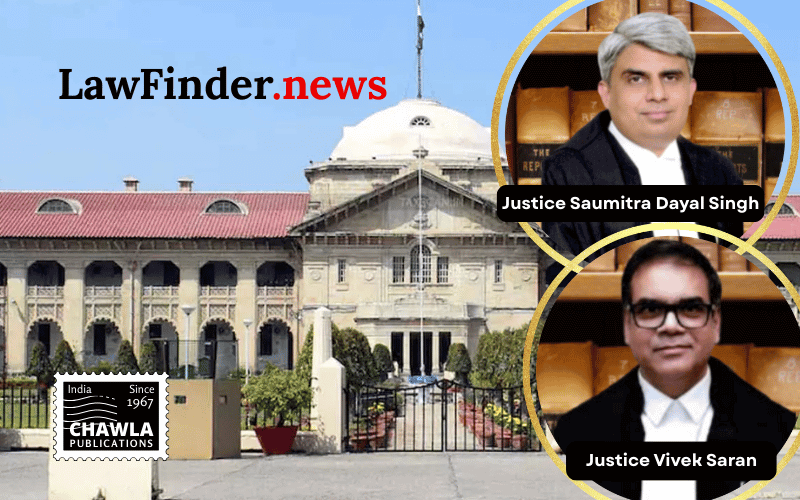

In a significant development, the Allahabad High Court has granted interim protection to M/S S.D. Freshners Ltd. and other petitioners in a case questioning the issuance of a combined demand-cum-show cause notice for multiple financial years under Section 74 of the Central Goods and Services Tax Act, 2017. The Division Bench, comprising Justices Saumitra Dayal Singh and Vivek Saran, heard the case on December 10, 2025, and extended interim relief to the petitioners, halting any coercive actions by the tax authorities until the next hearing.

The petitioners challenged the legality of a composite notice covering tax periods from 2017-18 to 2021-22, arguing that it violated principles of fairness in taxation by failing to disclose year-wise and item-wise tax details. The petitioners' counsel, led by Varun Srivastava, cited a precedent set by the Kerala High Court, which had ruled against such composite notices.

The court took note of similar interim orders in related cases, including those by the Madras, Karnataka, and Bombay High Courts, which have favored the assessees in similar disputes. The court emphasized the importance of judicial consistency and transparency, particularly when other High Courts have ruled in favor of the petitioners.

The respondents, represented by counsel including Krishna Agarawal and Parv Agarwal, requested additional time to file counter affidavits. The court has scheduled the next hearing for January 6, 2026, and has included the case among the top ten cases for that date, underscoring the urgency and importance of the matter.

The interim protection granted by the Allahabad High Court prevents any recovery actions by the tax authorities based on the impugned notices until further orders. This decision is expected to have significant implications for similar cases pending across various jurisdictions.

Bottom Line:

Issuance of a combined demand-cum-show cause notice for multiple financial years under Section 74 of the Central Goods and Services Tax Act, 2017 is questionable. Interim protection can be granted if principles of fairness in taxation are not adhered to.

Statutory provision(s): Central Goods and Services Tax Act, 2017, Section 74

M/S S.D. Freshners Ltd. v. Union of India, (Allahabad)(DB) : Law Finder Doc Id # 2822156