Court intervenes under Article 226 to permit salary payments amid pending money laundering adjudication.

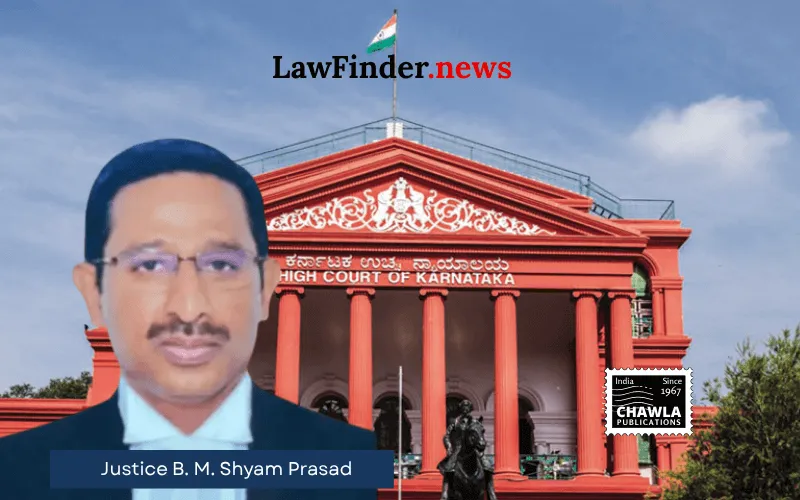

In a significant decision, the Karnataka High Court has intervened to allow Zo Pvt. Ltd. to utilize its frozen accounts for the disbursement of employee salaries, amidst ongoing adjudication proceedings under the Prevention of Money Laundering Act, 2002. The judgment, delivered by Justice B.M. Shyam Prasad, addresses the petitioner's grievance concerning the freezing of its accounts under Section 17(1A) of the Act, following a search and seizure operation at its outsourced accounting firm, FinAdvantage Consulting.

The petitioner, represented by Senior Advocate Sri Sajan Poovayya, sought relief from the court to operate its accounts for salary payments, arguing that the freezing order dated 30.12.2025 was impermissible. The court examined the scheme under the Act, noting that freezing orders require reasons for continuance and are subject to adjudication by the Adjudicating Authority. Despite the Directorate of Enforcement Ministry of Finance’s stance, represented by Standing Counsel Sri Madhu N Rao, that the freezing was based on practical necessity to prevent dissipation of proceeds, the court recognized the petitioner’s contention regarding the lack of material permissible under the Act for such satisfaction.

Justice Prasad emphasized that the petitioner’s business operations, including content generation and gaming segments, are lawful, and the need to pay salaries is justified. Referring to precedents such as M/s Art Housing Finance [India] Limited v. Directorate of Enforcement, the court directed the respondent to communicate with the bank to authorize salary payments after due verification. The court's order grants temporary relief for January to March 2026, subject to the adjudicating authority’s final decision.

The judgment underscores the balance between legal enforcement and operational necessity, permitting Zo Pvt. Ltd. to sustain its workforce while contesting the freezing order’s continuation beyond the statutory period.

Bottom Line:

Prevention of Money Laundering Act, 2002 - Freezing of accounts under Section 17(1A) - Court intervention permissible for operational use of frozen accounts to defray salary expenses during pendency of adjudication proceedings under Section 20 of the Act.

Statutory provision(s):

Prevention of Money Laundering Act, 2002 Sections 17(1A), 20, Article 226 of the Constitution of India.